Just like many other industries, the real estate market has slumped since the start of the COVID-19 pandemic. Increased restrictions, an atmosphere of uncertainty, a lull in business or at work. These are only some of the reasons that have led to less spending and an overall reluctance in making real estate transactions. The ride-it-out point of view is pretty understandable, with our brain telling us to be cautious in the choices that we make to ensure our survival.

However, experts and avid followers of the real estate industry in the Philippines believe that despite the circumstances of 2020, the Philippine property market is still poised for strong growth in the coming years as recent data and trends show.

Data Indicates Strong Growth in PH Property Market Post Pandemic

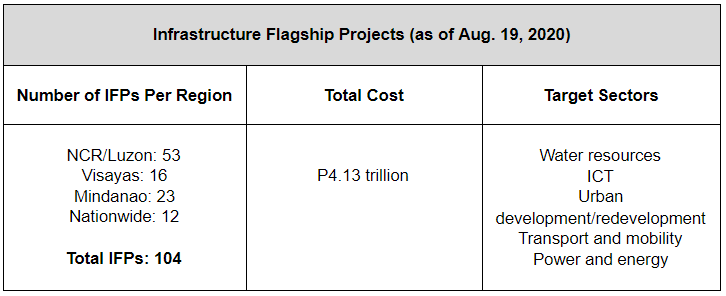

Increased focus on infrastructure

The government’s initiative to aggressively build public infrastructure has opened up opportunities for property developers. This is expected because infrastructure projects tend to increase the value of property in that area.

As such, property developers have begun to build residential areas close to places of work in alternative hubs, which include Bulacan, Pampanga, Southern Tagalog, Bataan, Visayas, and major food-producing provinces of Mindanao.

Massive infrastructure has also played a role in attracting multinational companies to outsource their work to several parts of the Philippines such as Cebu, Iloilo, and Davao, making them prime spots for development projects that focus on the demand for residential spaces.

The bustling economic activity in these provinces is so promising that it has caught the attention of Filipinos and foreigners alike. This is true especially for those who are on the lookout for properties that have the potential to increase in value in the near future.

As a result, many of them may be thinking of slowly moving away from the city, causing a drop in home prices within the metro. In fact, the price of a luxury 3-bedroom condominium unit in Makati, a major business hub, had a meager price increase of less than 1% in 2019, compared to almost 16% in 2018.

Below, the data shows the year-on-year price increase of condominium units in the posh district of Makati.

| Makati Luxury Condominium Price Increase | |

| 2018 | 15.55% |

| 2017 | 10.4% |

| 2016 | 9.95% |

| 2015 | 13.43% |

| 2014 | 7.11% |

| 2013 | 14.37% |

Despite the fluctuations, however, the price increases posted in 2017 and 2018 are still considered the largest growth rates in the property market among major cities worldwide. This should prove to be optimistic from your investor point of view.

The rise of modern-day buyers

In recent years, the real estate industry has been marked by innovations in the way that developers are running their business. They have become more open in riding the technological wave to better understand what you want and need as a buyer.

As such, developers have been designing homes with lots of open areas, green spaces, and sustainability features as you try to do your part in taking care of the planet. There are now also tons of mixed use developments that link your home, office, and favorite shops within a single community to help you live a convenient and comfortable lifestyle. If you’re working remotely, you shouldn’t have major problems finding a home with a larger space, some of which you can convert into a workstation.

You’ll also be glad to note that real estate companies are coming up with digital solutions for potential clients like yourself. Virtual property hunts and walkthroughs, online consultations with property agents, and product updates on social media are at your disposal to make it easy for you to go ahead with home shopping.

Active luxury market

Luxury condominium units have prices ranging from P8 million to P20 million, with some units even fetching higher prices. Notwithstanding, this market segment fielded stable numbers from 2017 to 2019, taking up about 52,000 pre-selling units per year.

What’s more, this impressive performance remained at that level even within the first six months of 2020. With its sterling track record, the luxury market is in the second spot of sales producers, accounting for 22% of properties in Metro Manila. The mid-income sector leads the race, representing 42% of property demand.

It’s also interesting to note that 94% of pre-selling luxury condominiums to be finished within the next two years are already sold, despite data showing that the cost of luxury residential developments around Metro Manila increased from 11% to 18% annually over the past five years.

Perhaps this is because a survey of per-square-meter prices of luxury infrastructures in Asian countries reveals that the Philippines is faring better than its neighbors. In Metro Manila, you’ll find that the priciest condominium projects range from P500,000 to P550,000 per sqm, but elsewhere in the world, things are way more expensive.

Take a look at this per sqm price comparison of luxury condominiums in global cities:

| City | Price per sqm |

| Metro Manila | 550,000 |

| Singapore | 1,500,000 |

| Hong Kong | 10,000,000 |

| New York | 5,000,000 |

| London | 7,500,000 |

The data shows that when it comes to real estate in the Philippines, the luxury property market remains resilient and competitive even during the most challenging of times.

Country’s attractiveness to foreign investors

With the law allowing foreigners to own a residential property in the Philippines, some 40% of condominium units are available for foreign investment. This means that even if you’re a foreigner, you can be the legal owner of your residence in the Philippines.

Take the Chinese, for example. They have been investing heavily in Philippine condominiums in recent years—accounting for approximately 41% of international sales among property developers— compared with American and Japanese nationals whose property investments are pegged at 30% and 5%, respectively.

This type of buying scenario may likely continue in the months or years to come. One telling sign is that in the midst of the COVID-19 pandemic, 68% of Chinese property investors have made inquiries on real estate in the Philippines.

Decade-long property boom

Most forecasts remain positive for 2021 regarding property in the Philippines, owing to the fact that the Philippine economy has been showing signs of improvement over the last decade. In 2010, the country’s gross domestic product (GDP) had a staggering growth of 7.3%, bouncing back from the previous year’s GDP of 1.1%.

Since then, the Philippines has experienced a property boom. Investments started coming in, and a host of other factors have helped the inventory of condominiums and commercial buildings to keep growing. For one, billions of dollars of remittances from overseas Filipino workers (OFWs) enabled their families to purchase residential properties.

At the same time, the young population of the Philippines was another contributor to the real estate industry as many of them worked in business process outsourcing (BPO) firms, which afforded them the purchasing power to invest in the property market.

Since 2013, the market for residential property in the Philippines has been a lucrative one overall. But in 2019, it was Makati and Taguig which had the highest inventory of condominium projects.

Fast forward to 2020, which is the time when the value of property in the Philippines skyrocketed to 27.1% in the first half of the year unlike the Malaysian and Japanese property markets, which both experienced overall price drops.

Because of this, it’s safe to say that the Philippine property market boom will continue its upward trend in 2021. Pasay City is expected to grow alongside other popular business centers, thanks to increased construction projects of commercial shops, office and government buildings, and recreation hubs in the Bay City of Manila. Needless to say, buying in the right project and area can help you take advantage of a booming market, with potential for a high return on investment should you decide to sell or lease your property later on.

Who Can Own Property in the Philippines?

1. Land ownership

Ownership of private land in the Philippines is reserved for Filipino citizens and corporations. In order for your corporation to be considered a Philippine national, it should have at least 60% Filipino ownership in the capital stock.

If you’re a foreigner, you can buy houses, buildings, or any structure built on Philippine soil, but you cannot own rights to the land on which the property stands. Separate titles for ownership can be given for the land and for the buildings on it.

2. Foreign Ownership

To reiterate, if you’re a foreign national or company who’s interested in land ownership in the Philippines, you have the option to purchase real estate properties without rights to land. This is known as The Condominium Act of the Philippines, where the term “condominium” broadly refers to residential structures as well as commercial buildings.

You may also take out a lease on land for a term of 25 years, with an option to renew the lease for another 25 years.

Alternatively, you may enter into a lease agreement with Filipino landowners for an initial term of up to 50 years, renewable once for 25 more years. Known as the Investors’ Lease Act, this is applicable if the purpose of lease is the construction of industrial estates, manufacturing plants, and other similar structures.

3. Partnerships and Corporations

As a foreigner, you’re allowed to own a property through a corporation, provided that 60% of the corporation is owned by Philippine nationals and that it’s duly registered with the Board of Investments. Under this option, you are entitled to acquire real estate of up to 1,000 sqm in cities and up to 2.5 acres of land in non-city areas.

The Concept of Pre-Selling Property in the Philippines

Pre-selling pertains to the stage when real estate companies start offering their condominium, townhouse, or house and lot properties to the market even though they’re still in the planning or construction stage. During this phase, you won’t be able to see an actual unit yet, but you can view the site and blueprints of the project.

The goal of pre-selling properties is for developers to generate enough funds, so they’ll have the financial resources to construct the buildings or structures. Pre-selling is also a way to counter recession in the real estate market since developers are assured that their projects would not end up unsold or unoccupied upon completion.

In the same manner, buying a property via pre-selling also affords you with a number of benefits:

- Cheaper prices. Pre-selling units are priced 30% cheaper than ready-for-occupancy units. In some cases, you’ll even be offered discounts ranging from 10% to 15% on top of the introductory price.

- Flexible financing terms. Generally speaking, pre-selling units are turned over to buyers a couple of years after the contract signing and payment of initial fees. This enables your developer to offer flexible payment schemes, including a low down payment on a staggered basis.

- Perks of choosing a specific unit or location. During pre-selling, you’re one of the first to see the property. As such, you get to have more say as to which street, floor, or tower you want to live in compared with those who choose to wait before the project is completed. For example, corner house and lots can give you extra space because you have fewer neighbors on the adjacent side, while a condominium unit on the top level can give you better views and more privacy.

Real Estate: Your Ticket to a Rewarding Future

Real estate is a rewarding venture. It allows you to own properties that appreciate in value, provide a living space, and be a potential source of revenue. Putting your money in real estate is a tangible investment that can give you passive income for years to come—something that can support your children and even your grandchildren.

After the pandemic, all of us who have been cooped up in our holes for the better part of 2020 will probably want to travel again. The difference between you and other travelers though is that your vacation has essentially paid for itself. Think of it this way. This plateau of economic activity due to the pandemic is the best time to scrutinize how you could start growing your money with real estate in the Philippines.

Start planning your real estate journey with Remax Gold today!