The Philippine real estate market sees an optimistic future despite the ongoing global fight against the COVID-19 health crisis. While the market took a significant blow due to the pandemic, the Philippine Central Bank expects it to recover firmly this year with 7.8% growth.

These days, real estate in the country is rising as a hot investment option. There may be an oversupply of properties around the metro and urban areas in the country due to the unforeseen health crisis; but developers are working on providing flexible interest rates, promos, and other conditions to assist the reviving market.

As the country gradually adjusts to the new normal and sees opportunities brought upon by the impact of the pandemic, many Filipino workers both domestically and overseas are eyeing the residential and commercial property market as a viable investment option while it recovers and offers more affordable and more considerate terms.

Options for Real Estate Investing

There are three main types of real estate you can invest in:

- House and Lots: These are residential properties where the investor buys and lives (or rents out) in the property. Some people choose to purchase land for residential development to build their dream home, while others opt for buying a house and lot that is ready to turn over once the construction is done.

- Condominium: A condominium is also a type of residential structure where each unit is owned separately by the tenants, but they share public areas and amenities, such as a swimming pool, gym center, and more. Condos are more like apartments since they’re in a shared complex or building.

- Commercial: Commercial properties often comprise office buildings and towers. Investors can purchase a unit in a commercial building and lease them out to companies and small business owners who will pay the rent to use the unit.

You need to compare and study the opportunities, benefits, and potential pitfalls before adding them to your investment portfolio. This article will compare and contrast the most common residential real estate investment options: condo vs. house, to help interested investors make more informed decisions.

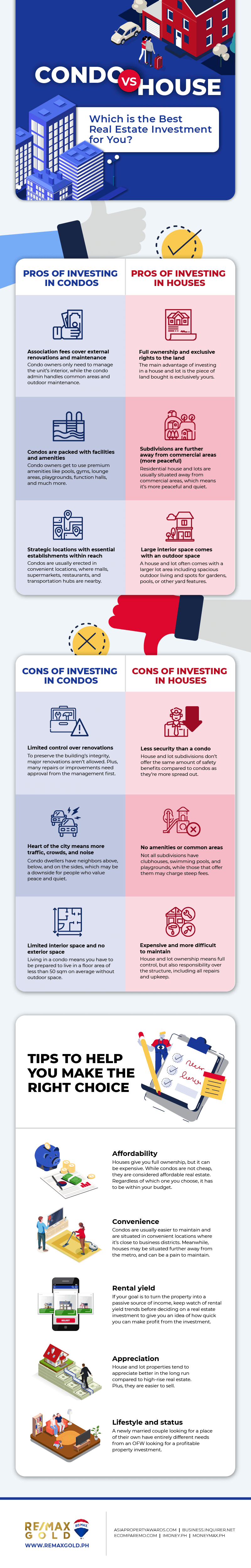

Condo vs. House: Which is the Better Option?

Houses and condos each have their own features, advantages and disadvantages, and square footage. One might be close to business districts and has a pool, while the other might be tucked in the suburb with a spacious garage and yard. There’s no one-size-fits-all answer to which one wins, but it all depends on your needs, lifestyle, and stage in life to choose the right decision. Take a closer look at both real estate to see which might be better for you.

Why a Condo is a Good Idea

Affordable property investment

One of the main reasons why many investors choose condominium units is that they are considered affordable real estate (except upscale condos in prime business districts). The prices of low-end and mid-range condos are usually within reach of first-time buyers and investors, as well as middle-income families and overseas Filipino workers (OFWs). You can find new condos starting at around PHP 4.1 million in Metro Manila and PHP 3.9 million in Tagaytay.

Easy property management and maintenance

Another upside of investing in condominiums is the ease and convenience when it comes to property management and maintenance, since investors aren’t required to maintain all the common areas. Condos have shared public spaces with other units and management is responsible for keeping these common areas and exterior spaces in its shape. Do note that any unit repairs or improvements you want to do must be approved by the management first.

High demand in the real estate market

Condos are usually just a stone’s throw away from the city’s comforts and conveniences, which can be attractive to busy professionals who wish to live close to their workplace.

Additionally, new real estate investors see growth opportunities in condos because there’s a higher demand for them. Young professionals today prefer renting more than buying a house and lot and usually only consider investing in a house later in life or when they start a family. Investing in condos allows you to develop them into a rental property business in the long run.

Why a House is a Good Option

Legitimately owned land

While a detached, single-family home typically costs more than a condo, they’re also bigger than condominium units. More importantly, when you purchase a house, you own exclusive ownership of the entire land, inside and out—and you can do anything you want with it. If the property you’re eyeing is big enough, you can build a private pool or a large garden, which can be a spot for backyard gatherings.

You can find house and lots priced at PHP 9.5 million in Metro Manila and PHP 3.2 million in Tagaytay.

Accommodates life’s changes

House and lots are more fitting for professionals who are starting a family because they offer more room to grow. You can break down or add walls, convert a spare room into a home office or baby room, build a deck and storage room in the backyard, or even start your own food delivery business out of the house—all of which aren’t possible with a condo.

Moreover, a house better accommodates sudden changes in living arrangements. If a family member or relative unexpectedly needs to stay with you for a couple of months, there isn’t an issue. Many condos have restrictions that would prevent such arrangements.

Easier to sell than a condos

Detached, single-family houses in prime residential areas and privately owned lots are more liquid in all types of markets, unlike condos. Condominiums can be difficult to sell when the housing market is in bad shape. Plus, there’s the individuality aspect to consider. Every house is unlike any other, which can appeal more to specific buyers. Meanwhile, condos are harder to differentiate from one another.

Are You Ready to Buy a Property?

Evidently, there are advantages and disadvantages to each real estate investment type. That’s why it’s crucial that you consider your needs, lifestyle, financial health, and goals to choose the best option for you.

Neither of the two investment types is better than the other. In the end, it all comes down to where you are in life and your personal preference.

Property investing can be a little overwhelming, especially if you’re new to it. So, if you need help with your property investment, get in touch with the experts at RE/MAX for a free consultation!