This is the ultimate guide that will answer all your questions about Real Estate investing in the Philippines. In this comprehensive guide, we’ll cover:

- growth opportunities,

- regional data and insights,

- listing platforms, foreign ownership,

- and much more.

So, if you’re researching options to buy a home or invest in real estate, this is a perfect guide for you!

Let’s get started!

Chapter 1: The Opportunity

Growing BPO and IT-BPM industry, OFW remittances, and being a top tourist destination are some of the driving forces behind the thriving real estate market in the Philippines. The property boom now extends to provincial cities such as Cebu and Clark, where both serve as prime investment locations for those looking for metro-like business lifestyle destinations outside Metro Manila.

Furthermore, as these driving forces continue to rise combined with the rising urban population, so does the demand for commercial and residential properties as well as mixed-use projects. Since the country has a developing economy, no shortcomings in opportunities are in sight, especially since more people are moving to urban areas and adopting urban lifestyles. For local and foreign investors, these provide enough reason to invest in the Philippines’ property market.

Chapter 2: Real Estate Pricing & Growth

The Philippines has set off as a prime hotspot for foreign property and business investors in Southeast Asia. Lamudi’s real estate market review in 2019 found that more property seekers are buying (60.59%) than renting (39.41%). The most popular cities they’re interested in are Makati, Quezon City, Manila, Taguig, and Cebu. Meanwhile. The top provincial cities are Cebu, Bacoor, Davao, Angeles, and Antipolo.

In Asia, the average apartment price per square meter in the Philippines cost $3,952 or PHP 199,597. The number is based on web listings from prime cities in the country (administrative capital, financial capital, and center of rental market).

Meanwhile, house price growth year over year in the Philippines is as follows.

The graph shows that house price growth hit an all-time high of 10.4$ in September 2019. The record low of -0.4% occurred in September 2015.

Chapter 3: Rental Yields Market Data

Rental prices remain at a reasonable rate in the Philippines, with condominiums providing the highest yields for real estate investors. Expectedly, rental units in prime and large cities like Metro Manila bring exceptional yields since this is where expats and other high-paid workers prefer to stay.

Below are the countries with the highest rental yields in Asia.

As you can see, despite being at the more affordable end of the spectrum when it comes to price per square meter, rental yields in the Philippines are some of the highest in Asia. Surprisingly, yields on small units do not always high, which means there’s an oversupply of smaller condo units. As expected, the rate of return on large units (around 250 sq.m) in Metro Manila rates high.

Chapter 4: How to find Properties for Sale

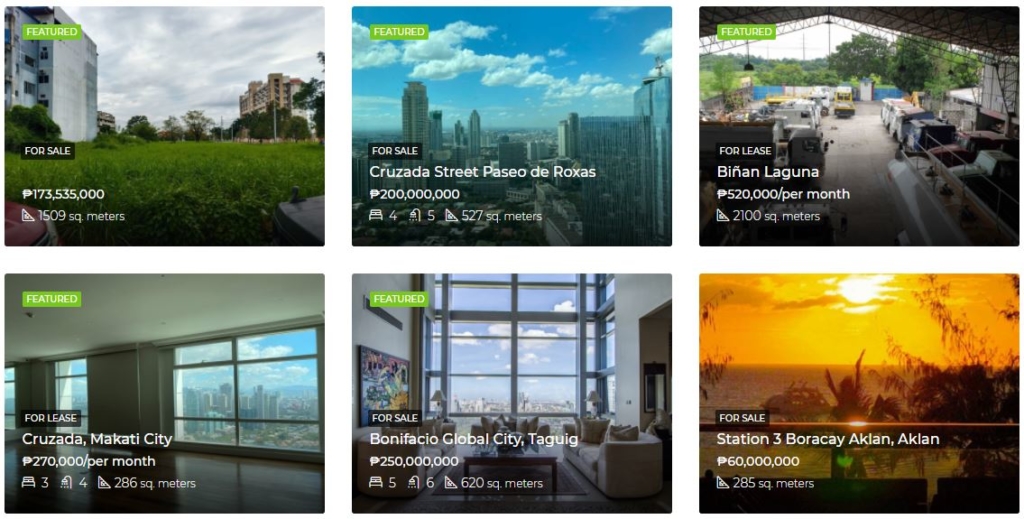

You can check out real estate listings online through various platforms. Below are some of the most reliable go-to resources that connect buyers and sellers of real estate properties in the Philippines.

- Lamudi – Lamudi is one of the biggest players in real estate market globally and the leading real estate platform in the country. They help property seekers find their ideal property, whether it’s for personal use or as an investment. Lamudi draws roughly 230,000 visitors weekly in the Philippines alone thanks to their thousands of listings available for rent and sale.

- MyProperty – MyProperty has an easy-to-navigate website that makes property searching convenient for people looking for houses and lots, for rent spaces, or office spaces. The site makes sure to keep their listings updated with the latest information to help homebuyers make sound purchase decisions.

- Hoppler – Hoppler assigns a dedicated broker, a Hoppler Associate, for those who inquire for a property. They will arrange and coordinate processes on the buyer’s behalf for a more convenient property hunting experience. The site shows listings that include condominiums, apartments, and house and lots for sale and for rent in major areas, such as Alabang, Makati, BGC, Ortigas, Eastwood City, and more.

- PropertyfinderPH – Property Finder has been helping both property buyers and sellers for about 16 years. Individuals can streamline their search by selecting a listing type (for sale or for rent) or property type (residential, commercial, and land). They allow sellers to list their properties for free, which makes it a more accessible service to all.

- PhilippinesProperties – Philippines Properties is owned and operated by Logic Replace LLC. Sellers and landlords can list properties for free, but they offer paid listings where they can show more pictures or videos of the property and rank above free listings. Their map search feature lets property hunters to view listings on an interactive map display, allowing them to concentrate their search on specific areas.

- Zipmatch – Zipmatch plays as a matchmaker to buyers and sellers. They aim to make finding a home as convenient and seamless as possible for everyone involved in the process. Individuals can browse via premium listings, popular condominiums, fresh listings, and preferred neighborhoods.

- Banks – Security Bank, PNB, PSBank, BDO, and DBP, among others, have web pages that list their repossessed real estate properties for sale. Here, you’ll find some of the best deals on the market, so be sure to check them out from time to time. If you’re interested in a listing, you can send them an inquiry or make an offer.

Not all properties will be listed on these platforms. So be sure to also check on classified ads, social media groups, online marketplaces, and through commercial brokers or real estate agents. Do also note that the platforms above are easily accessible online, so excellent deals may quickly get snatched up by other interested buyers or investors. If you want to play the field, you’ll need to act fast!

Chapter 5: 2020 Laws for Foreign Ownership

Foreigners may own a property in the Philippines under several conditions. They can own condominium units in the country subject to a 40% restriction, but they are prohibited from purchasing and owning land. Below are some of the exceptions for foreign ownership:

- The property was acquired before the 1935 Constitution.

- Acquisition of property was made through hereditary succession.

- If the property was bought by the owner when he or she used to be Filipino citizens, they will maintain ownership, but will be subject to restrictions.

- For former natural-born citizens, urban land ownership shall be limited to 1,000 sq.m while rural land must not go over 1 hectare and must be for residential purposes only as prescribed by Batas Pambansa 185.

- Foreigners are allowed ownership of only one type of land: urban or rural—not both.

- Ownership is limited to only two lots. These lots must be in different cities or municipalities in the Philippines.

- Foreigners may own buildings or houses, but not the land where the properties stand on. They may only lease in a long-term contract good for 50 years. Afterward, the rent is renewable every 25 years.

- For businesses or other commercial purposes, foreigners are allotted 5,000 sq.m of urban land or three hectares of rural land. The land shall be primarily used in conducting the owner’s business or commercial activities in the areas of agriculture, industry, and services, including the renting out of land except the buying or selling thereof.

Chapter 6: Effect of Chinese POGOs

The Philippine government authorized Philippine Offshore Gaming Operators or POGOs to set up virtual casinos in select locations in the country. One POGO license requires a minimum of 10,000 sq.m of office space, and they bring many employees along. As a result, there has been increased demand for commercial and residential properties as these POGO workers need places to stay.

Philippine Amusement and Gaming Corporation (PAGCOR) is the primary regulatory body for offshore gaming services. One of the most important rules that POGOs must comply with is barring Filipino citizens from participating in their gaming platform. Despite this prohibition, the government allows them to operate in the country for their hefty contribution, with a hefty sum of PHP 33 million required to set up a single POGO.

In 2019, DOLE issued over 143,000 alien employment permits (AEP) to POGO-related workers, about 80% of them Chinese nationals. From January to mid-February this year, 20,000 AEPs were issued. Undeniably, the increasing presence of these online gaming casinos is firing up the local real estate scene. The POGO industry is expected to become the primary real estate driver as it continues to grow at a faster rate than the IT-BPM sector.

Chapter 7: Manila: Makati/BGC, Ortigas, QC

Manila serves as the prime location for business and investment in the country. The city ranks 9th place among the fastest-growing Asia-Pacific cities in the 2018-2022 growth forecast and continues to attract investors, workforces, and people who desire to live an urban lifestyle.

Makati

Makati is known for its strategic business district that provides convenient access to public transport systems and pedestrian-friendly streets. Its residential properties sit an arm’s length away from commercial establishments as well as businesses and offices.

The average property price in Makati for condominiums cost PHP 134,725 per sq. m., PHP 132,164 per sq. m. for landed houses. Meanwhile, rental rates average at PHP 910 to PHP 1,100 per sq. m.

Bonifacio Global City (BGC)

BGC is a business district that doesn’t get heavily congested like Makati and Manila. More importantly, BGC houses a few green pocket spaces and community parks, promoting a nature-friendly environment. The area also boasts its shopping malls, bustling nightlife, and vibrant dining scene—perfect for young professionals who live and breathe work.

The average property price in BGC for condominiums cost PHP 117,439 per sq. m., PHP 77,102 per sq. m. for townhouses. While the average rent prices in BGC stand at about PHP 900 per sq. m.

Ortigas

More property developments continue to pop up in Ortigas as more businesses open up operations in the area. Ortigas’ main selling points are easy accessibility via private and public transport, affordable residential spaces, and its variety of leisure activities, commercial establishments, and lifestyle centers.

Property prices in Ortigas go for about PHP 105,000 per sq. m. The average lease rates in the Ortigas-Pasig-Mandaluyong area are around PHP 500 per sq. m.

Quezon City

Quezon City is a highly-urbanized city in an area that is home to many condo communities strategically built near transport systems, business hubs, commercial establishments, and premier institutions. As the formal capital city of the Philippines, there’s no shortage of opportunity when it comes to business, retail, and leisure.

The average condo price in Quezon City costs PHP 4.52 million at about PHP 120,000 per sq. m. While average rental prices are about half that of Makati (PHP 600 per sq. m.).

Chapter 8: Locations Near Manila

More businesses and investors are looking beyond the great metropolis (but not too far) for real estate investment opportunities. Below are some of the promising locations near Manila.

Alabang

Alabang is known to have modern shopping centers, lifestyle complexes, commercial establishments, and a bustling business hub. It also poses as another spot for high-end real estate developments, with reputable developers building their projects in the area.

In 2019, it was estimated that the property market value around Alabang rates at around PHP 100,000 per sq. m. or higher.

Tagaytay

Many people’s favorite leisure destination near Manila is Tagaytay. Its weather, commercial establishments, and incredible ambiance never disappoint. This is a good real estate investment location for those who wish to live in a more natural setting that’s not too far from the metropolis.

You can find a decent house and lot properties in Tagaytay priced at around PHP 9.3 million or PHP 39, 020 per sq.m.

Batangas

Batangas is known as the go-to beach destination for weekend getaways. The location is perfect for those who want to live in a more peaceful environment than Manila that’s not too urbanized. AboitizLand announced the development of its industry city LIMA in Lipa, an integrated township that houses top manufacturing companies and a soon to rise residential area.

You can find a house and lot property in Lipa, Batangas priced at PHP 5 million or PHP 37,879 per sq.m.

Santa Rosa

Santa Rosa is the hub to some of the country’s biggest corporations, such as Coca-Cola Bottlers Philippines, Inc. It also takes pride in its master-planned communities, including Ayala Land’s Nuvali and Greenfield City’s mixed-use development. Santa Rosa is envisioned to become the “Makati of the South.”

You can find a house and lot property in Santa Rosa priced at PHP 8.5 million or PHP 53,797 per sq.m.

Pampanga

The government’s “Build Build Build” projects (i.e., expansion of Clark City) has bolstered the region’s growth. Clark City stands as a major BPO center in Pampanga, and it continues to attract BPO firms considering the city as a branch site for their Metro Manila-based operations.

You can find a house and lot property in Angeles, Pampanga priced at PHP 5.2 million or PHP 41,269 per sq.m.

Bulacan

JLL, the country’s leading real estate research consultancy form, identifies Bulacan as one of the provinces where a significant interest for residential and industrial sectors will rise. Just 11km north of Manila, Bulacan’s close proximity to the metro makes it a growing hub for various industries such as manufacturing, agriculture, finance, and hospitality.

You can find a house and lot property in Santa Maria Bulacan priced at about PHP 2.8 million or PHP 34,937 per sq. m.

Chapter 9: Overview of Cities outside of Manila

Metro Manila may be the country’s primary economy driver, but cities outside the capital are rising as major cities on their own.

Cebu

Population: 2.9 million (2015)

Annual population growth rate: 2.22%

The booming BPO industry in Cebu continues to attract investors. With this comes the demand for office spaces. Data shows that the average office rental rates in Cebu starts at PHP 400 to PHP 1,100 per sq.m.

The average residential rent prices in Cebu cost PHP 500 to PHP 1,520 while selling prices start at PHP 52,000 per sq.m per month to PHP 316,000 per sq.m per month.

Davao

Population: 1.63 million (2015)

Annual population growth rate: 2.30%

Davao is known as one of the safest and cleanest cities in the country. It has also become highly urbanized, offering more affordable real estate investment opportunities than ever before. Plus, the cost of starting a business in Davao costs significantly less than in other prime cities in the Philippines.

The average residential rent prices in Davao cost PHP 610 to PHP 1,130, while selling prices start at PHP 78,370 per sq.m per month to PHP 216,000 per sq.m per month.

Bacolod

Population: 561,875 (2015)

Annual population growth rate: 1.79%

Bacolod emerges as a fast-growing BPO hub in Western Visayas. The flourishing workforce and surging businesses in the area are driving demand for residential properties and office spaces. A 2018 report showed that houses and lots in Bacolod are in demand as it attracts outsourcing investments as local officials consider the BPO industry as a major job-generating sector.

The average price of a property in Bacolod is roughly P5.46 million, whereas the average size of one property is 932 sq.m (about PHP 5,858 per sq.m).

Iloilo

Population: 1.94 million (2015)

Annual population growth rate: 1.34%

BPO companies and contact centers are the main drivers of office space occupancy, also helping to boost the demand for residential and retail properties. National developers like Ayala Land, Megaworld, and SM Prime are flocking to Iloilo to build projects such as office space developments and capitalize on the city’s rapid growth.

The average price for “elite” subdivision lots in Iloilo can range from PHP 4,000 to PHP 7,000 per sq.m.

Baguio

Population: 361,569 (2015)

Annual population growth rate: 1.54%

Many BPO firms are expanding in Baguio, and its tourism sector remains strong as ever. These factors contribute to a relatively high demand for real estate rental properties catering to different demographics, including working millennials.

The average property prices in Baguio cost PHP 89,022 per sq. m. for condominiums and PHP 39,919 per sq. m. for townhouses.

Tarlac

Population: 1.37 million (2015)

Annual population growth rate: 1.35%

Industrial hubs are heading north of Luzon. Moreover, Ayala Land is developing a mixed-use estate in Tarlac, including an industrial park and commercial lots. They’re also slated to build commercial projects in the area in 2021. Development projects like this signal strong growth in this area and correspond to increased demand for residential properties.

You can find a house and lot for sale in Tarlac priced at PHP 6 million or PHP 15,000 per sq.m.

Chapter 10: Overview of Beach investments

The Philippines is known for its breathtaking islands and pristine beaches around the world. Owning a beachside house and lot, condominium unit, apartment , or commercial property in these areas serve as an attractive investment opportunity.

Boracay

Boracay is best known for its white sandy beaches. Real estate investors can leverage Boracay’s tourism industry and as a prime development area for optimal gains. You can land yourself a commercial lot on this pristine island for just PHP 30,000 per sq.m (2,400 sq.m lot area).

Palawan

Palawan is one of the most visited tropical destinations in the world. Owning a property in the area serves as a good investment opportunity if you’re renting it out to local and foreign tourists. You can find a commercial/residential lot in El Nido priced at about PHP 9,000 per sq.m.

Cebu

The Queen City of the South boasts its unspoiled beaches and incredible waterfalls, such as the famous Kawasan Falls. As a bustling business hub and a home for scenic landscapes, Cebu offers the best of both commercial and leisure opportunities. You can find a beachfront house and lot (1,200 sq.m or less) in Southern Cebu priced at PHP 5,000 per sq.m.

Bohol

Famous for its Chocolate Hills, white sand beaches, and other tropical discoveries, Bohol is an ideal retirement destination for those who prefer to spend their lives in a more tranquil environment. You can get yourself a beachfront property overlooking the sea in Dauis, Bohol priced at PHP 6,000 per sq.m (1,463 sq.m lot area).

La Union

Local and foreign tourists alike flock to La Union not only to surf but also to check out the other tourist attractions and its booming commercial establishments. A beachfront lot in San Fernando City costs about PHP 15,000 per sq.m (200 sq.m lot area).

Siargao

Known as the surfing capital of the Philippines, Siargao has built a reputation for itself among local and international surfers. A lot of travelers who’ve been to Siargao find it a good place to settle in and invest, whether for commercial or leisure purposes. A commercial lot in General Luna, which can be developed into a hotel, costs around PHP 12,000 per sq.m (2,000 sq.m).

Baler

Baler is a province in Aurora famous for its beautiful beaches and playful waves that attract surfers. It’s also home to some of the most spectacular rock formations in the country. There’s a development project in Baler with patches of subdivision lots priced at PHP 5,000 per sq.m.

Chapter 11: The Legal Process in the Philippines

Buying and owning a real estate property in the Philippines can be a tedious process. You have to go through several steps (depending on the type of property), settle all documents and requirements, and pay fees. Take a look at the instructions for transferring of titles for properties below.

- The buyer and seller agree on a sale of a property. A lawyer creates and notarizes a Deed of Absolute Sale (DoAS).

- Parties secure a Land Tax Declaration from the Bureau of Internal Revenue (BIR) and submit it to the city or municipal Assessor’s office.

- The buyer will settle real estate tax at the City Treasurer’s office.

- The city Assessor’s office assesses the market value of the property.

- The buyer will pay for the transfer taxes to the Assessor’s office.

- The Documentary Stamp and Capital Gains tax are settled at the BIR’s office.

- The Registry of Deeds cancels the ownership title of the seller and issues a new one under the buyer’s name.

- The buyer, now the new owner of the property, receives copies of the new title, and requests a tax declaration from the Assessor’s office.

Here are the types of real estate documents concerning the purchase of the property:

- Contract to Sell – A document that affirms the agreement of the developer to transfer ownership of the property to the buyer.

- Deed of Sale – A legal document validating the agreement between a buyer and a seller on the sale of a property.

- Certificate of Title – A document that reflects the proof of ownership provided by the Registry of Deeds.

- Declaration of Real Property Tax – A document carried out by the City Assessor that states the market value of a property as the basis for real estate tax collection.

Below are the transaction costs involved in purchasing a property:

| Fees and Charges | Amount | Paid By |

| Notary Fee | 1%-2% | Buyer |

| Local Transfer Tax | 0.50%-0.75% | Buyer |

| Registration Fee | 1% | Buyer |

| Documentary Stamp Tax | 1.50% | Seller |

| Capital Gains Tax | 6.00% | Seller |

| Real Estate Agent’s Fee | 3.00%-5.00% | Seller |

Chapter 12: Pro Tips for Real Estate Investing in the Philippines

Investing in real estate usually requires a large initial sum. That’s why it’s crucial that you do thorough research before signing any deals. We’ve listed a few tips to help you boost your chances of a successful real estate investment:

Identify your target market – Knowing your target market is just as crucial as the location. Developers build projects that cater to specific market segments. If you’re aiming to rent out or resell a property, always aim for contemporary and make sure that your target market or potential tenants can meet your asking rate.

Know your financing strategy – Can you afford to buy a property upfront, or will you need financing or loans? You can look into financing options through banks or government housing loans to finance your property investment.

Research – Before sealing the deal, look into the developer of the project, review their track record, and ask for feedback from existing owners to see if they deliver on their promises.

Determine growth areas – Observe if there are signs of further development around the area, such as land development, plans of lifestyle or shopping centers and commercial establishments, and other construction projects to see if the property has potential to appreciate in value.

Layout an investment plan – When you’ve finally chosen a property to invest in, your next step is to identify your time frame for return on investment (ROI). This way, you get to calculate how much profit it needs to generate and help you make informed decisions.

Consider your financial goals – How do you plan to earn from your property? How much should your earnings be if you decide to rent out your unit or property? Do you plan to keep investing in more properties and renting them out for regular passive income? Above all else, remember that your investment should go with your financial goals to help you see the big picture or draw an exit strategy for your investment.

Best Property Deals Right Now

Real Estate Government Agencies in the Philippines

- Housing and Land Use Regulatory Board (HLURB) – The main agency that oversees and enforces policies on land use, housing and homeowners associations, environmental protection, and adjudications of disputes.

- Home Development Mutual Fund (HDMF) – This is also known as the PAG-IBIG Fund. It was established to offer affordable housing assistance and lends its members short-term loans.

- The Registries of Deeds – The office tasked with providing information about land titles. It is also responsible for the collection of legal and fund fees and works in cooperation with other agencies in collecting taxes such as capital gains tax, estate tax, land transfer tax, real estate tax, and more.

- Social Housing Finance Corporation (SHFC) – SHFC powers the National Home Mortgage Finance Corporation. The agency provides low-income families and homeless people with Fair, Affordable, Innovative, and Responsive (FAIR) shelter programs.

Better Real Estate Investing in the Philippines

The real estate market in the Philippines shows no signs of slowing down. More regions and cities outside the thriving metropolis have shown attractive performance, which has brought in more opportunities for commercial, residential, businesses, and retail sectors in the country. With this, property investment opportunities for all budget ranges are abound.

Now is a great time to look into real estate investments in the Philippines. Feel free to reach out to Remax Gold to help you find the best property deals!