If it’s your first time diving into real estate investment, this could be an exciting time for you. There are a lot of opportunities coming your way! However, as a rookie, you should know that there is much more to real estate investing than just the property itself. Some terms and concepts are bound to show up in front of you. Therefore, you should familiarize yourself with the terms used in real estate investing.

This infographic will explain what the commonly used real estate investment terms are, along with some examples.

Real Estate Investment Dictionary: 20 Must-Know Terms

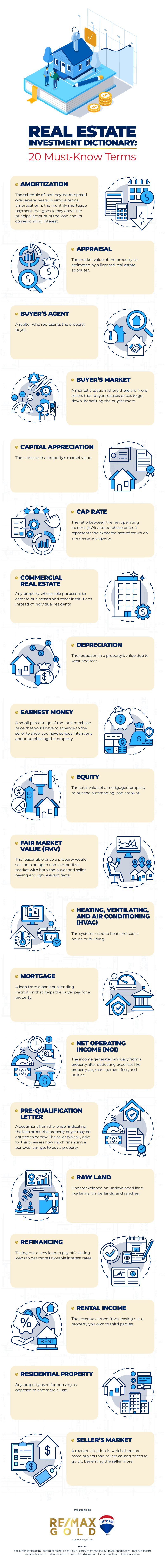

1. Amortization

Amortization refers to the schedule of payments of the loan principal and interest. Typically, the payments made at the beginning of the loan will primarily go to the interest, while later payments go to the principal loan amount.

However, some things can reset the amortization process, the most common being the refinancing of the mortgage loan. Refinancing restarts the amortization curve. After refinancing, you will start loan payments anew, paying more toward the interest than the principal.

2. Appraisal

This refers to the estimated value of a property based on how much others within the area are selling. Generally speaking, banks require appraisals before issuing loans to ensure the property’s value is more than what you’re borrowing. Appraisals are also necessary when refinancing mortgages and are done by licensed appraisers.

3. Buyer’s Agent

If you’re looking to purchase a new property for the first time, your best chance at getting the most cost-effective deal is through a buyer’s agent. A buyer’s agent can help you with the ins and outs of property buying. They can save you a ton of time, money, and effort. Some things a buyer’s agent can do are the following:

- Find the right property

- Negotiate the offer

- Recommend other real estate professionals

- Help overcome setbacks

4. Buyer’s Market

This is sometimes called a cold real estate market, which favors those willing to buy a property because more people are trying to sell properties than those who want to buy one. This increase in supply usually drives the prices down, making it beneficial for buyers.

5. Capital Appreciation

Capital appreciation is the increase in a property’s value relative to its purchase price.

Example: If an investor buys a property worth ₱3 million in 2016 and its value increases to ₱3.5 million in 2021, then there is a capital appreciation of ₱0.5 million.

Capital appreciation will only be recorded if revaluation happens or if the owner re-appraises the property. Once the property is sold, the difference between the original price and the sale price can give you a capital gain or capital loss, depending on whether the property was sold at a profit or loss.

6. Cap Rate

Cap rate, also known as capitalization rate, is the ratio between the net operating income (NOI) and purchase price. Simply put, it’s how much return on investment you expect to make on a property annually.

You can calculate the cap rate by dividing the first year’s expected NOI by the property purchase price. NOI would exclude loan costs if you purchased the property through financing

Formula: NOI / Property purchase price = Cap rate

Example:

Expected NOI (1st year) = Php120,000

Property purchase price = Php1,500,000

Php120,000 / Php1,500,000 = 0.08

Cap rate = 8%

7. Commercial Real Estate

This refers to any property whose sole purpose is to host business operations rather than serve as a living space. Commercial real estate is one of the two primary categories of real estate properties, the other being residential. Commercial real estate may include these property types:

- Office space

- Warehouses, depots, or storage facilities

- Retail space

- Hotels

8. Depreciation

This is the reduction in a property’s value due to wear and tear. While the land itself does not depreciate unless it is degraded by erosion, the facilities erected on the land (i.e. the buildings) do depreciate.

9. Earnest Money

Earnest money is an initial deposit made by a buyer to show they’re serious about purchasing a property. Typically, the deposit is about 1% to 2% of the property’s purchase price and is deducted from the total purchase price.

In a purchase agreement, the seller takes the property off the market and prepares to close the purchase. If the deal falls through, the seller will have to re-list the property and start all over again in finding a buyer, resulting in a big financial hit. Through earnest money, the seller has some form of financial protection should the buyer back out.

10. Equity

Equity is the difference between your property’s market value and the amount you owe the lender who holds the mortgage. Equity is the amount of money you’d receive after paying off the mortgage if you were to sell the property.

Example:

Fair market value of your property = Php2,000,000

Mortgage = Php1,500,000

Equity = Php500,000 (assuming you sell the property at fair market value)

One way to build equity is by making a larger down payment, paying off your mortgage more quickly, and improving the property to increase its value. In contrast, you can lose equity by increasing your loan amount or when the house’s value is reduced due to neglect, damage, or unfavorable market changes.

11. Fair Market Value

Fair market value (FMV) is the reasonable price a property would sell for in an open and competitive market. With the buyer and seller having enough information about relevant facts, both parties agree on the price and a reasonable time to complete the deal.

12. Heating, Ventilating, and Air Conditioning (HVAC)

HVAC systems are used to heat and cool the house. You must understand how an HVAC system works, so you’ll know how they are to be maintained. Routine maintenance on HVAC can help properties last longer . It’s also important to note that there are cities where if property owners fail to address HVAC issues, fines or forced rent concessions may be enforced.

13. Mortgage

A loan from a bank or other financial institution typically runs for a long time ranging from 15 to 30 years, depending on the agreement. If the loanee doesn’t meet the payment terms of the lender, the latter may reclaim the property through the process of foreclosure to recoup its money.

14. Net Operating Income

This pertains to the income that can be generated annually from the property after deducting property expenses like property tax, management fees, and utilities. As such, mortgage payments are not part of your property’s net operating income (NOI). NOI is calculated by estimating the expected revenue and then subtracting operating expenses, including maintenance and repairs, real estate property taxes, and homeowners association fees.

15. Pre-Qualification Letter

A document from the lender stating how much loan may be approved for a borrower based on initial discussions between both parties. The pre-approval letter is not a guaranteed loan offer; in fact, this is only the first step in getting a housing loan. The seller typically asks for this to ensure you are eligible to get financing to buy the property.

16. Raw Land

This is underdeveloped or undeveloped land like farms, timberlands, or ranches. It is a property in its most natural state wherein there is no cultivation of the land for crop or livestock, and there have not been any structures built or improvements made

17. Refinancing

Refinancing involves restructuring an existing home loan for a new one by working with a lender to pay off the old mortgage. Many property buyers choose to refinance to lower the interest and, at the same time, shorten their payment terms. They can also take advantage of turning some of the equity they’ve earned into cash.

18. Rental Income

This is the revenue earned from leasing out the property you own to third parties.

19. Residential Real Estate

Residential real estate is any property used for housing. There are four examples of residential real estate:

- Townhouse – Also called a townhome, a townhouse is usually a multi-level property that shares one or two exterior walls with adjacent real estate.

- Standalone house – This is also called a single-family home. These properties stand on their lots. A standalone house is the most common type of residential real estate.

- Condominium – A condo is a privately-owned residential unit for individuals situated within a community of other condominiums.

- Multi-family house – Examples of these include duplexes and fourplexes. A property with more than five units is usually considered commercial real estate.

20. Seller’s Market

This is a market situation where there are more buyers than sellers. Because of the limited supply, property prices tend to shoot up, which benefits the sellers more in the transaction. This situation usually happens if the employment rate is improving and interest rates are low.

Paring it down

As a first-time real estate investor, doing research can be a tedious task. There is so much to learn about the industry of real estate investment, but we hope that our real estate dictionary can help you achieve a better understanding of the market. For more assistance regarding real estate investment, don’t hesitate to contact our experts at RE/MAX for a free consultation.